And why quality always pays you back.

As the global economy started recovering from the recession caused by the Covid-19 pandemic, there has been an increased demand for products – especially consumer goods – and materials.

The ongoing war in Ukraine is a significant factor contributing to higher commodity prices, pushing up inflation worldwide. The cost of raw materials had been on the rise since the onset of COVID-19 about two years back. With strict sanctions against Russia and damaged infrastructure in Ukraine, the prices are expected to remain high and volatile.

Every industry in the world, including cable making, is being heavily impacted by escalating and unpredictable input expenses, such as raw material input cost inflation and price fluctuations.

Hard market conditions force traders and manufacturers to use premium prices. The LME explains that premium prices exist in metals markets because the global reference price, discovered on the LME, is based on a standardised metal grade and shape. Deviations from this metal standard need to be reflected in the final price paid in the physical market. When negotiating the price of a contract to take delivery of physical metal, buyers and sellers will usually start by referencing the LME price for the underlying material and then negotiate discounts and premiums based on the various factors affecting delivery as well as the type (brand, shape or quality) of metal being bought or sold.

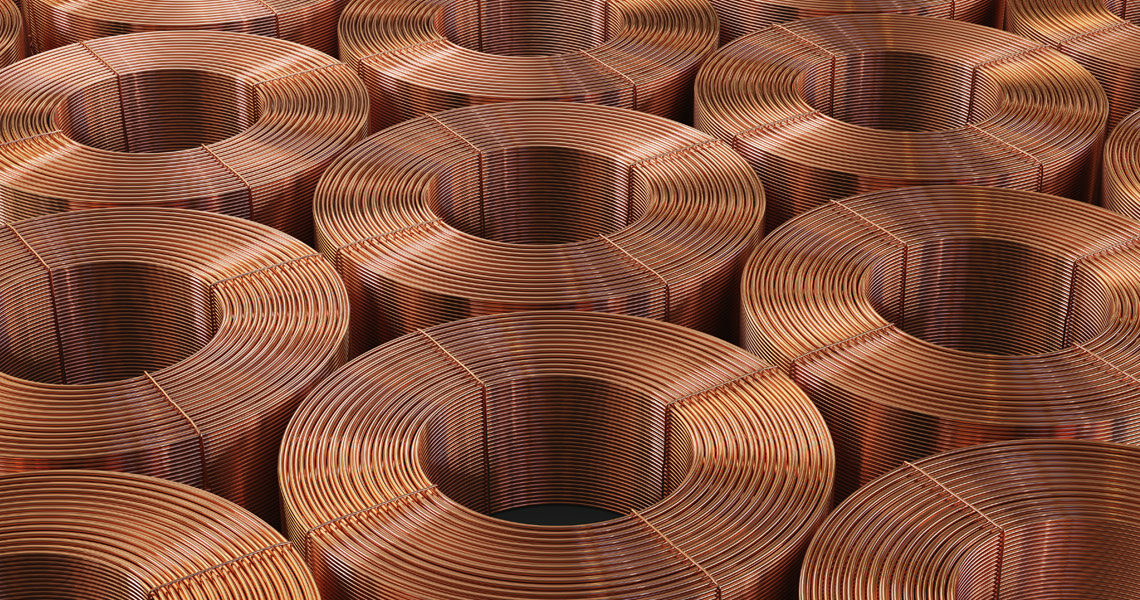

According to Reuters, European copper buyers are going to be paying a lot more to get their copper next year. A combination of high freight and power costs and low visible copper stocks has driven the price of copper high.

German producer Aurubis will charge $228 per tonne over the London Metal Exchange (LME) cash price for term deliveries in 2023, a record high and an 85% increase on this year’s premium of $123. Chilean giant Codelco has come in higher still with a premium of $235 per tonne, while Austria’s Montanwerke Brixlegg has thrown down the green gauntlet with a 295 euro (US$289) premium for low-carbon copper.

Unfortunately, it’s true even for Tratos, which is currently forced to apply a premium price for its products on top of the LME price.

However, Tratos cable is worth its price as Tratos distinguish itself from the others by putting quality first and protecting the environment! Tratos design and manufacture the cables it produces in such a way as to reduce to the bare minimum in relation to environmental impact in the use of raw materials, without affecting the cable safety, reliability and cost.

Tratos’ cables are designed with clever theft-prevention technology, such as identifying threads alarming cables that make cable theft less rewarding. Tratos cables are made with copper and aluminium cladding, which makes them unique and prevents cable theft. The aluminium cladding makes the copper inside the cable lose its value for selling as scrap by metal thieves.

Our clients have witnessed up to a 90% reduction in the need to conduct tests on their transmission lines and avoid delays in running their services. This has resulted in savings of 40% of maintenance costs in the long run.

Tratos is proud of its culture of innovation, which is driven by more than just need; it is driven by “better”.

In 2019 Tratos won a Queen’s Award for Enterprise: Innovation for a problem-solving cable compound developed originally for use on mobile and fixed Offshore Oil and Gas installations.

Tratos has been a partner of ITER (International Thermonuclear Experimental Reactor) fusion for energy cable project since its inception. Tratos purpose-built cable is a critical component of some of the biggest and most challenging superconducting electromagnets ever produced in the history of mankind.

Buy Tratos cable! Buy once! Save money and time!