This article dives into the importance of copper in securing our sustainable future. The demand for copper is growing, and there might not be enough to meet this rising need. This could lead to a shortage and result in higher prices, possibly even encouraging more copper production. But how will this impact our progress towards cleaner, more efficient energy sources? Throughout this article, these questions and more will be addressed. The importance of copper in creating a sustainable world is highlighted, detailing its unique place in the evolution of green technologies.

History of copper

Copper was the first metal manipulated by humans, and it remains an important metal in industry today (Pappas, 2018). It can be found naturally in pure metallic form; therefore, it was relatively easy for ancient humans with their primitive tools to extract and use copper without the need for complicated techniques and technology that was developed later by mankind.

As a chemical element, copper has the following properties:

- Atomic number (number of protons in the nucleus): 29

- Atomic symbol (on the periodic table of elements): Cu

- Atomic weight (average mass of the atom): 63.55

- Density: 8.92 grams per cubic centimetre

- Phase at room temperature: solid

- Melting point: 1,984.32 degrees Fahrenheit (1,084.62 degrees Celsius)

- Boiling point: 5,301 degrees F (2,927 degrees C)

- Number of isotopes (atoms of the same element with a different number of neutrons): 35; 2 stable

- Most common isotopes: Cu-63 (69.15% natural abundance) and Cu-65 (30.85% natural abundance)

(adapted from Lenntech.com)

Since its discovery, copper was first used for coins and ornaments. A small copper awl found in Israel has been dated to ~5,100 BC. Even older (~8,700BC) is a copper pendant uncovered in the region that is now part of northern Iraq. So, it seems on current evidence that we figured out how to extract native copper from its ores almost 11,000 years ago, well before any of the other native metals associated with prehistoric civilisations were in use (Tyson, 2021).

Archaeologists are inclined to believe from evidence uncovered so far that it wasn’t until 4,000 – 3,000 BC, during the mid-Mesopotamian era, that more sophisticated methods of extracting copper were developed. Notably, they discovered that by heating copper-containing rocks, they could extract even more of them. Prehistoric miners used a technique

called fire-setting. Fires were lit up against the rock or working face to heat the rocks. Cold water was then thrown onto the hot rocks to soften and crack them, making it easier for miners to extract the copper from the normally hard rock with their primitive tools (Tyson, 2021).

Humans have been making things from copper for at least 8,000 years and figured out how to smelt the metal by about 4500 B.C. Copper was an essential element which helped mankind’s evolution. It played a central role in mankind’s transition from the Stone Age to the Bronze Age, a period covering approximately 3300 to 1200 B.C, as ancient people learned to mix copper with tin to create bronze. The Bronze age is distinguished by historians as the period when for the first-time humans started to work with metal and to use bronze tools and weapons (History, 2018),

The ancient people used copper for medical purposes, as well. The Egyptians used copper to sterilise water and treat infections. Smith Papyrus is one of the oldest books known. Written between 2600 and 2200 B.C., it records the use of copper to sterilize chest wounds and to sterilize drinking water (Copper.org, 2000).

As copper is a good conductor of electricity as well as being ductile, it was extremely important in the industrial revolution. Copper was the first metal traded on the London Metal Exchange (LME) when it was founded in 1877. Due to its widespread use in industry, copper is viewed as being closely connected to macroeconomic events – so much so that some say ‘Dr Copper’ has a PhD in economics (LME, 2021).

Copper production

According to Lenntech, world production of copper amounts to 12 million tons a year and exploitable reserves are around 300 million tons, which are expected to last for only another 25 years. About 2 million tons a year are reclaimed by recycling.

Today copper is mined as major deposits in Chile, Indonesia, USA, Australia and Canada, which together account for around 80% of the world’s copper. The main ore is a yellow copper-iron sulphide called chalcopyrite (CuFeS2).

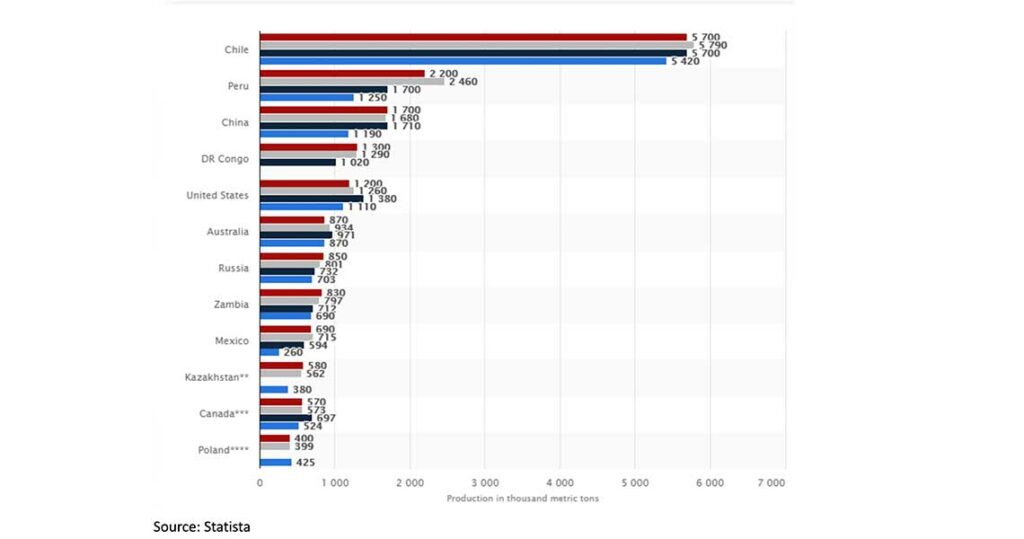

Statista has listed the major countries in copper mine production worldwide from 2010 to 2020(in 1,000 metric tons) in the following order:

Chile, the world’s leading copper producer by far, produced an estimated 5.7 million metric tons of copper in 2020. In second place is Peru, with an estimated copper mine production of 2.2 million metric tons in the same year. The world’s third-largest copper producer from mines is China. In 2020, China produced an estimated 1.7 million metric tons of copper from mines, which is over three times less than Chile’s production.

In the UK, because of its close association with tin in the mines, copper must almost certainly have been found in Cornwall as far back as 1000 B.C. The chief British copper mines were at Alderley Edge in Cheshire, where the easily worked malachite was abundant. There were others at Amlwch, in Anglesey, also in North Wales, Shropshire, Coniston and southwest Scotland.

The peak of British copper mining was during the earlier part of the 19th century, when Great Britain contributed more than half of the world’s output, the bulk coming from Cornwall. By the end of 19th century, however, the large, readily available quantities that had been opened up by foreign mining, coupled with the growing exhaustion of the Cornish mines and the serious trouble and expense due to the water in the workings, reduced the output of Cornish ore from 18,300 tons per annum to virtually nothing. But by 1933, the world’s reputed output from smelters had risen from 291,000 tons in 1852 to about three million tons annually. The greatest single cause for this great expansion was the enormous growth of the electrical engineering industry (Bromehead, 1947).

Mining in Cornwall and Devon, in the southwest of England, began in the early Bronze Age, around 2150 BC, and ended with the closure of South Crofty tin mine in Cornwall in 1998. As of 2007 there are no active metalliferous mines remaining (Wikipedia, 2021).

Copper use

Copper and copper alloys are widely used in a variety of products that enable and enhance our everyday lives. They have excellent electrical and thermal conductivities, exhibit good strength and formability, have outstanding resistance to corrosion and fatigue, and are generally nonmagnetic. They can be readily soldered and brazed, and many can be welded by various gas, arc and resistance methods. They can be polished and buffed to almost any desired texture and lustre.

We use copper in pots and pans, in the water pipes in our homes, and in the radiators in our cars. Copper also plays an essential role in computers, smartphones, electronics, appliances and construction.

Copper use in construction is preferred in part because of its aesthetic appeal but also because it does not burn, melt or release toxic fumes in the event of a fire. Furthermore, copper is one of the few metals that does not lose its chemical or physical properties during the recycling process. An estimated 80% of historically mined copper is still in use today. Copper’s recycle value is so great that premium-grade scrap normally has at least 95% of the value of primary metal from newly mined ore. (copper.org, 2021)

As pure copper is a soft ductile metal, in anticity humans have used copper to make items that didn’t require much rigid strength, for example jewellery, decorative artefacts, utilitarian items like vessels, and some types of light duty tools.

Ötzi the Iceman, a 5,300-year-old frozen man found in the Italian Alps near Ötzi, had an axe with him that had an almost pure copper head. Ötzi’s axe was preserved intact and is the only one of its kind in the world. The blade consists of 99.7% pure copper and is trapezoidal in shape. The knee haft is made from yew and is approx. 60 cm long. The copper blade is fixed into the forked shaft of the haft with birch tar and is tightly bound with leather straps to hold it firmly in place. The blade was cast in a mould, cooled and then compressed by hammering. Signs of wear show that the axe had been frequently used and therefore had to be re-sharpened. The copper used in the blade does not derive from the Alpine region but from Central Italy. Researchers have discovered that the metal had been obtained from ore mined in South Tuscany (Iceman.it, 2021).

In ancient Egypt, the mummy of Tutankhamun proved to our modern world how advanced the Egyptians were at metalworking. Most everyday items like water vessels, hand mirrors, razors and the chisels used to smooth the limestone blocks of the great pyramids, were made of copper. Copper was used to create a blue glaze that was popular during King Tut’s reign some 3000 years ago and he was buried with a stack of tiny copper farming tools to help him in the afterlife (copper.org, 2005, Tyson 2021).

The use of copper in heavy duty tools, didn’t happen until around 3,300 BC when they learned to mixing it with tin, another metal of antiquity, to produce a much harder, stronger metal called bronze. This discovery ushered in the Bronze Age, and marked the beginning of the end for stone and bone tools. Around 1,400 BC humans discovered copper also worked well with another antique metal, namely zinc, and so brass, another incredibly valuable copper alloy, was born (Tyson, 2021).

Nowadays copper is the 3rd most used industrial metal in the world. The only metals we use more of are iron and aluminium (Livescience, 2021). Around 75% of the copper produced today is used in the electronics, communication and energy industries where its excellent conductivity and ductile properties make it ideal for wiring and electronic circuitry, telecommunication cables, and electrical wires. In fact, 60% of copper ends up in wiring alone (Tyson, 2021). The average car contains 1.5 kms of copper wiring, weighting 20-45 kg (USGS, 2009).

Coppers and certain brasses, bronzes and copper nickels are used extensively for automotive radiators, heat exchangers, home heating systems, solar collectors, and various other applications requiring rapid conduction of heat across or along a metal section. Because of their outstanding ability to withstand corrosion, coppers, brasses, bronzes and copper nickels are also used for pipes, valves and fittings in systems carrying potable water, process water or other aqueous fluids, and industrial gases (Copper.org, 2021).

When it comes to electrical conductivity, only silver outranks copper: the conductivity of silver clocks in at 63 x 10^6 siemens/meter, roughly seven percent higher than the conductivity of annealed copper, which stands at 59 x 10^6 siemens/meter (Sciencing.com, 2021). That’s why copper is widely used in everything from the electrical wiring in our houses to renewable power sources like wind turbines. Copper can help to achieve a greater efficiency of other materials and thus it is going to play an important role in achieving a more sustainable future.

Energy efficiency brings a competitive advantage. Copper is the best nonprecious conductor of heat and electricity, which is essential to an efficient generation and delivery of electricity to homes and businesses. Additionally, copper helps the products containing it to operate at peak efficiency. Using inferior conductors reduces efficiency, leading to wasted energy, higher utility bills, and increased greenhouse-gas emissions (Copperalliance.org, 2021).

Copper also promises to play an essential role in the transition to the low-carbon economy. A greener, healthier and more sustainable future relies on the use of copper. Products containing copper tend to operate more efficiently because copper is the best nonprecious conductor of heat and electricity.

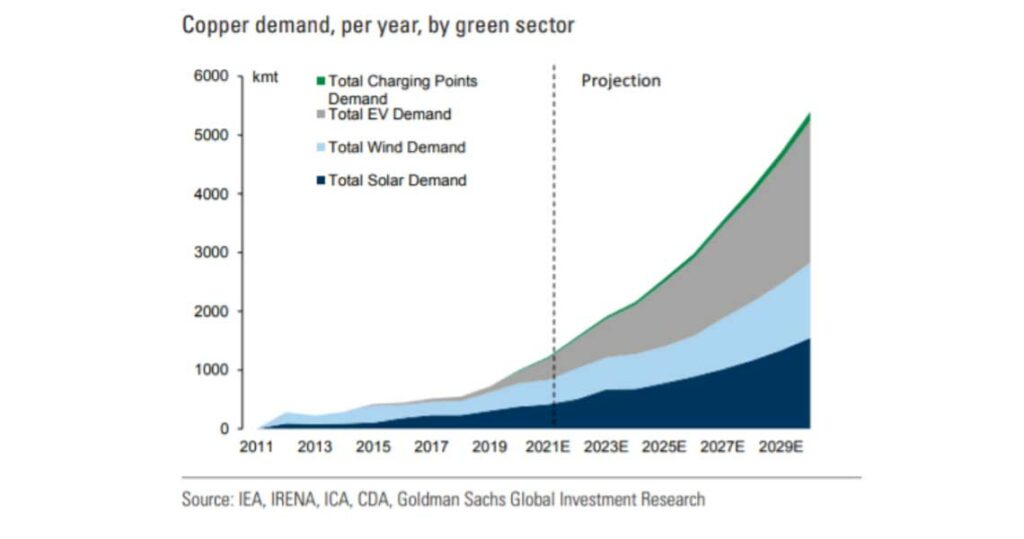

Just one 1MW wind turbine, for example, uses three tonnes of copper. And electric vehicles have a copper intensity 3-4 times higher than traditional vehicles. Copper is already an important ingredient in our most innovative technologies, such as smart energy technology, aquaculture and electric cars, and its role in electromobility, energy efficiency and renewable energy is growing. Because of this, McKinsey has estimated a 43 percent potential increase in copper demand by 2035 versus today’s demand of 22 million tonnes (McKinsey Institute 2017).

In summary, copper’s main industry uses are:

- Wiring

- Piping

- Electric product manufacturing

- Transportation

- Building construction

- Infrastructure

- Power generation

Copper and our health

The oldest recorded medical use of copper is mentioned in the Smith Papyrus, one of the oldest books known, written between 2600 and 2200 B.C., describing the application of copper to sterilize chest wounds and drinking water. The use of copper in medicine became widespread in the 19th and early 20th centuries, and a variety of inorganic copper preparations were used to treat chronic adenitis, eczema, impetigo, scrofulosis, tubercular infections, lupus, syphilis, anaemia, chorea, and facial neuralgia (Dollwet et Sorenson,1985).

The use of copper as an antimicrobial agent continued until the advent of commercially available antibiotics in 1932. The spread of antibiotic resistance through selective pressure began and today has made antibiotic-resistant bacteria ubiquitous in hospitals, nursing homes, food processing plants, and animal breeding facilities. This has raised the need for different approaches to keep pathogenic microorganisms at bay. One such alternative is the use of copper surfaces in hygiene-sensitive areas. Hospital trials have shown a reduction in bacterial counts, indicating that copper surfaces are a promising additional tool alongside other hygienic measures to curb the number and severity of hospital-acquired infections (Grass G, et al. 2011).

A recent study performed during the Covid-19 pandemic found that copper destroys the replication and propagation abilities of SARS-CoV, influenza, and other respiratory viruses, having high potential disinfection in hospitals, communities, and households. Copper can eliminate pathogenic organisms such as coronavirus bacterial strains, influenza virus, HIV, and fungi after a short period of exposure. Copper seems to be an effective and low-cost complementary strategy to help reduce the transmission of several infectious diseases by limiting nosocomial infectious transmission. Copper oxide or nanocompounds may be used as filters, face masks, clothing, and hospital common surfaces to reduce viruses and bacterial incubation (Cortes, 2020).

Copper is an essential element that humans and other species require in their bodies on a daily basis. Humans need 1.2 milligrams of copper daily to help enzymes transfer energy inside cells (Angloamerican, 2019).

According to Lenntech, Copper can be found in many kinds of food, in drinking water and in air. Because of that we absorb eminent quantities of copper each day by eating, drinking and breathing. The absorption of copper is necessary, because copper is a trace element that is essential for human health. Although humans can handle proportionally large concentrations of copper, too much copper can still cause eminent health problems.

Copper concentrations in air are usually quite low, so that exposure to copper through breathing is negligible. But people that live near smelters that process copper ore into metal, do experience this kind of exposure.

People that live in houses that still have copper plumbing are exposed to higher levels of copper than most people, because copper is released into their drinking water through corrosion of pipes.

Occupational exposure to copper often occurs. In the working environment, copper contagion can lead to a flu-like condition known as metal fever. This condition will pass after two days and is caused by over sensitivity.

Long-term exposure to copper can cause irritation of the nose, mouth and eyes and it causes headaches, stomach-aches, dizziness, vomiting and diarrhoea. Intentionally high uptakes of copper may cause liver and kidney damage and even death. Whether copper is carcinogenic has not been determined yet.

There are scientific articles that indicate a link between long-term exposure to high concentrations of copper and a decline in intelligence with young adolescents. Whether this should be of concern is a topic for further investigation.

Industrial exposure to copper fumes, dusts, or mists may result in metal fume fever with atrophic changes in nasal mucous membranes. Chronic copper poisoning results in Wilson’s Disease, characterized by a hepatic cirrhosis, brain damage, demyelization, renal disease, and copper deposition in the cornea

When copper ends up in soil it strongly attaches to organic matter and minerals. As a result, it does not travel very far after release and it hardly ever enters groundwater. In surface water copper can travel great distances, either suspended on sludge particles or as free ions.

Copper does not break down in the environment and because of that it can accumulate in plants and animals when it is found in soils. On copper-rich soil only a limited number of plants have a chance of survival. That is why there is not much plant diversity near copper-disposing factories. Due to the effects upon plants copper is a serious threat to the productions of farmlands. Copper can seriously influence the proceedings of certain farmlands, depending upon the acidity of the soil and the presence of organic matter.

Copper can interrupt the activity in soil, as it negatively influences the activity of microorganisms and earthworms. The decomposition of organic matter may seriously slow down because of this.

Copper price

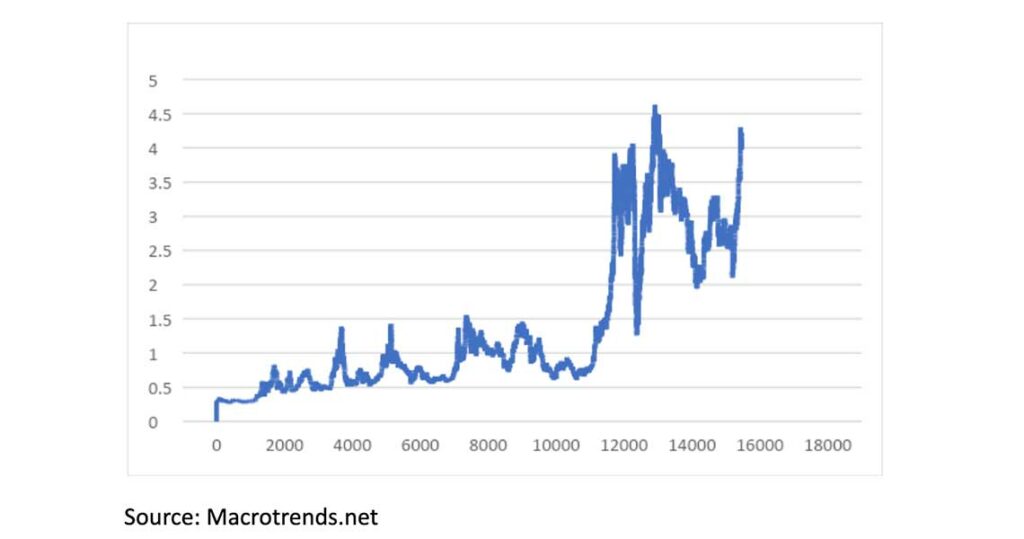

The Macrotrends’ Copper Prices – 45 Year Historical Chart, shows that on 2 July 1959 one pound of copper was at $0.293. Historically, Copper reached an all-time high of $4.63 /lb in February of 2011. Copper prices increased more than 11% during the first three months of 2021, hitting their highest level since 2011. On 24 February 2021, the copper price was $4.37/lb. The lowest point for copper during this year was on Jan 28, 2021, when its price was £3.49/lb.

The ongoing Covid-19 pandemic, which started at the end of December 2019, with its restrictions still in place, has caused series of shocks to industrial commodities like metals and oil, which have seen extremes, both on the upside and downside. While Covid-19-led lockdowns across the globe destroyed demand in the early part of 2020, a supply cut-driven rally and sharp recovery in the auto sector have emerged as big themes.

Metals are at the heart of the new commodity super cycle, and green demand is at the heart of the metal’s price rally. Metals prices have certainly benefited strongly as a result of post Covid-19 expected economic recovery, especially China’s “V” shape recovery, with copper rising to a two-year high and looking set to continue rising as construction, infrastructure, electrification and the roll out of 5G technology all contribute to strong demand growth.

In its report “Green Metals- Coper is the new oil”, Goldman Sachs predicts a further price increase of copper that could break records in the near and midterm future due to the resurgent demand and capped supplies.

Copper will be crucial in decarbonization and in producing more renewable energy sources. Copper has the physical attributes needed for creating, storing and distributing clean energy from the wind, sun and geothermal sources. Copper will be needed to create the new infrastructure systems required for clean energy to replace oil and gas. Demand will therefore significantly increase, by up to 900% to 8.7 million tons by 2030, if green technologies are adopted en masse, the bank estimates. Should this process be slower, demand will still surge to 5.4 million tons, or by almost 600%.

Copper is a key part of sustainable technologies, including electric vehicle batteries and deriving clean energy. As the deadline of the Paris Agreement comes closer, political and economic pushes towards renewable energy and green technology are becoming stronger (Goldman Sacs, 2021).

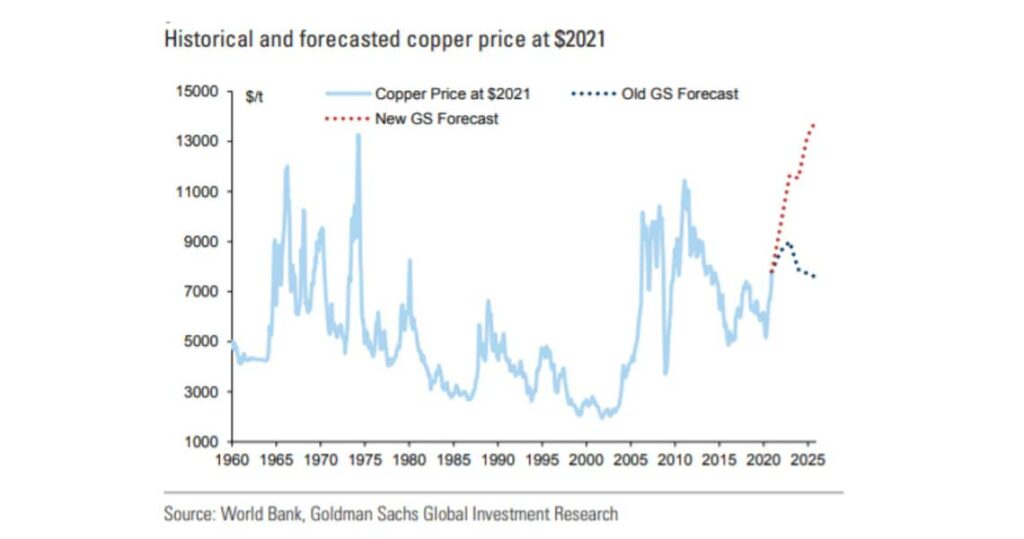

At mid-April 2021, the London Metal Exchange (LME) reported that copper traded around $8,900 per metric ton. Goldman Sachs predicts prices to average $11,000 over the next 12 months and $15,000 by 2025.

In its April 2021 released report, Goldman Sachs has argued that the critical role copper will play in achieving the Paris climate goals cannot be understated. Without serious advancements in carbon capture and storage technology in the coming years, the entire path to net zero emissions will have to come from abatement – electrification and renewable energy.

As the most cost-effective conductive material, copper sits at the heart of capturing, storing and transporting these new sources of energy. In fact, discussions of peak oil demand overlook the fact that without a surge in the use of copper and other key metals, the substitution of renewables for oil will not happen. Copper has the necessary physical properties to transform and transmit these sources of energy to their useful final state, such as moving a vehicle or heating a home.

By 2030, copper demand from the transition will grow nearly 600 per cent to 5.4Mt in our base case and 900 per cent to 8.7Mt in the case of hyper adoption of green technologies (Goldman Sachs, 2021).

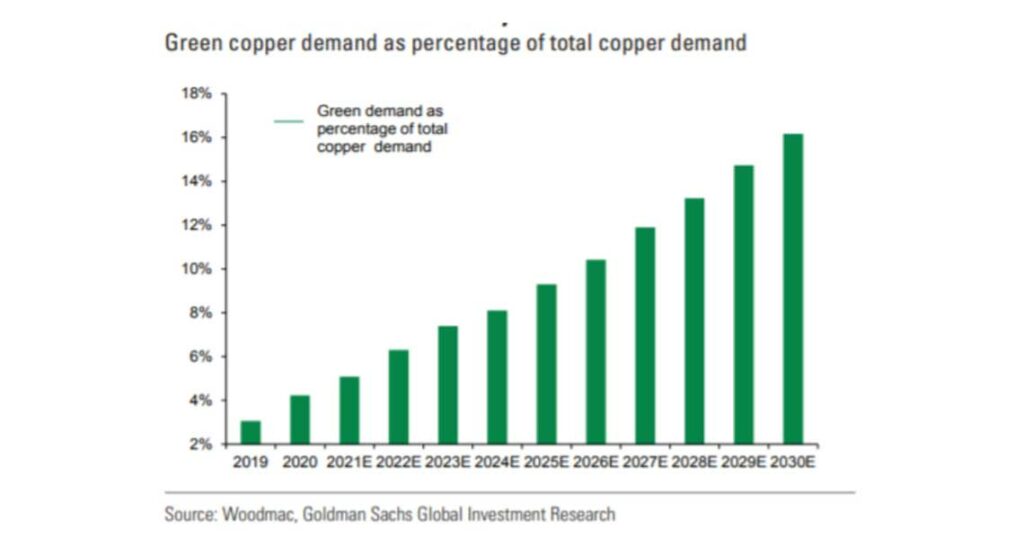

The copper market as it currently stands is not prepared for this demand environment. This combination of surging demand and sticky supply has reinforced current deficit conditions and foreshadows large open-ended deficits from mid-decade. Goldman Sachs estimates a long-term supply gap of 8.2Mt by 2030, twice the size of the gap that triggered the bull market in copper in the early 2000s. Their analysis shows that in aggregate ‘green’ copper amounted to 1Mt in 2020, just 3% of total global copper. However, Goldman Sachs modelling suggests under their base case, a rapid acceleration in green demand growth from here rising to 2.6Mt by 2025 (9% total global demand) and then 5.4Mt in 2030 (16% of total global demand).

They estimate that green demand will grow at average annual growth rate of 20% y/y in the 2020s, generating just under 500kt per year of growth in demand volumes.

By 2025 Goldman Sachs projects that copper price is on a necessary path to $15,000 per ton to avoid both depletion risk and as well as a sharp surplus swing.

In addition to the Goldman Sachs, global commodities trader Trafigura sees a significant supply deficit in the copper market and a prolonged high-price cycle. Possibly in the region of 10 million tonnes of additional copper is required to balance the market by 2030(Reuters, 2021).

According to Trafigura, the global non-ferrous market in 2020 was dominated and defined by the impact of COVID-19. Put simply, it came down to a trade-off between both primary and secondary supply disruptions and demand destruction. The supply and demand for each metal was largely determined by geography. For instance, due to mine disruption in South America, copper and, to a lesser extent, zinc faced greater losses in production than in consumption, as demand was more resilient than for other metals. Aluminium, on the other hand, faced only minor supply disruptions, almost exclusively in the scrap market, but suffered a collapse in demand owing to its larger exposure to the automotive and aerospace sectors.

Looking ahead to 2021, while the general expectation is that COVID-19 disruptions will be significantly less, other risks to supply, such as industrial action, remain very real.

Crucial in defining the future supply-demand profile of each metal will be the extent of governmental economic stimulus packages focused on infrastructure and the electric vehicle revolution. Although COVID-19 has materially impacted near-term balances of non-ferrous metals, the outlook from 2025 onwards is bullish for the whole sector.

Like many other globally traded commodities, copper experienced significant demand destruction in 2020, but this was coupled with significant disruption on the supply side, notably in terms of scrap supply and primary production in Latin America. Once demand returned after the initial shock, a tight supply-demand balance became evident in the latter part of the year, supported by copper-friendly government economic stimulus policies. As a result, prices quickly rallied in May in what became a V-shaped recovery.

The future for copper will be bright as a result of growing demand for electricity and government policies aimed at economic recovery and combatting climate change. The latter include incentives for the purchase of electric vehicles and Europe’s Green Deal support package for clean energy. Global investment in power grids is also increasing – a trend we expect to continue in the future. This will likely result in a significant copper supply gap that will drive prices higher to incentivise new production.

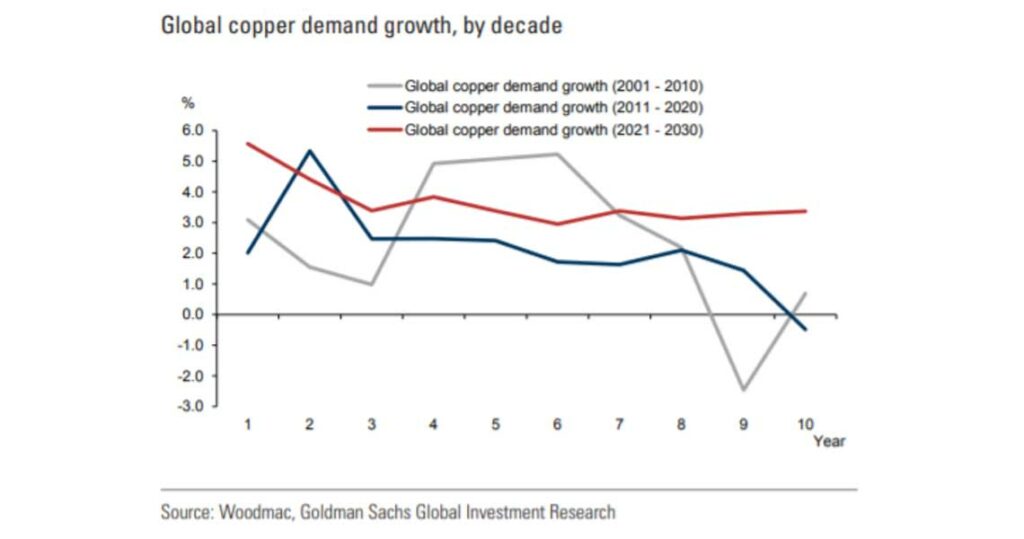

In line with Trafigura’s findings, Goldman Sachs and Woodmac have projected the following copper demand growth:

As copper will be in high demand in the next coming years, its dynamic price would be the ultimately the tool for generating the fundamental adjustments into the global copper market. According to the Goldman Sachs modelling of scrap and substitution effects into supply-demand balance, as well as reviewing the available greenfield project economics, the immediate conclusion in this context is that current copper prices ($9,000/t) are too low to prevent a risk of inventory depletion, while current long-term copper ($8,200/t) is not high enough to incentivise adequately greenfield projects to solve the long-term gap. If copper remains at $9,000/t through the next three years, then the resultant deficits would generate a depletion of market inventories by early 2023.

Based on scrap and demand modelling, Goldman Sachs believe that the most probable path for copper price from here – that both avoids depletion risk and as well as a sharp surplus swing – is to trend into the mid-teens by mid-decade. They project copper to average $9,675/t in 2021, $11,875/t in 2022, $12,000/t in 2023 before a material step up to $14,000/t in 2024 and $15,000/t in 2025. This means the metal balances into mid-decade remain manageable without depletion occurring. Whether prices need to rise further post-2025, will then depend on whether the price rally has supported enough mine supply response by that stage.

The argument for higher near-term copper prices has been underpinned by the need to limit inventory depletion risks into mid-decade via scrap and demand substitution responses. However, the copper market also faces a record long-term supply gap reflecting the impact of green electrification driving an accelerated trend in global demand contrasting with a peak in base case mine supply.

Trafigura expects copper to breach $10,000 a ton this year, before entering a range of $12,000 to $15,000 a ton over the coming decade. Other ardent copper bulls including Goldman Sachs Group Inc., Bank of America Corp. and Citigroup Inc. have similarly strong near-term forecasts, but Trafigura has set itself apart with its lofty long-term target. Goldman expects copper to hit $10,500 a ton within 12 months, while Citi sees it reaching $12,000 next year in its bull-case forecast. In the years to come, that’s likely to become the floor for prices as the industry re-values the metal (Bloomberg, 2021).D

Copper and energy sustainability

As copper has a superior electrical and thermal conductivity, is highly durable and can be 100% recycled, without any loss in performance, according to the European Copper Institute, there are 10 good reasons and figures why copper should be a material of choice when it comes to building a more sustainable energy system:

Copper as a good conductor of electricity and heat

Adding 1 kg of copper saves 100 to 7,500 kg of CO2

Every conductor in the electrical system has a built-in resistivity. This means that part of the electrical energy that it carries is dissipated as heat and is lost as useful energy. For a given conductor diameter, those energy losses can be reduced by choosing a material with a high electrical conductivity. The electrical conductivity of copper is second only to silver and is 65% better than aluminium. These energy losses can be further reduced by increasing the conductor diameter. While this cannot be increased endlessly, the environmental optimum, for transformer and motor windings, electrical cables, and traction overhead lines, lies at a significantly higher conductor size than prescribed by current standards. Carbon emissions saved per additional kg of copper over the lifetime of the device are between 100 and 7,500 kg depending on the application.

Adding 1 kg of copper saves 500 to 50,000 kWh of primary energy

Reducing energy losses by increasing the diameter of the copper conductor means that less electrical energy needs to be generated, transported, and distributed. Between 500 and 50,000 kWh of primary energy are saved over the life cycle of the system for each additional kg of copper used. Moreover, these savings delay the need to invest in new grid capacity and other infrastructure.

Adding 1 kg of copper saves the economy 24 to 2,400 euros

The energy savings that result from increasing the conductor diameter lead, in the vast majority of cases, to a reduction in the life cycle cost of the system. For intensively used electrical devices, such as cables, transformers and electric motors, the cost of energy losses over their lifetimes are many times the initial purchasing cost. The 500 to 50,000 kWh that are saved by each additional kg of copper, will save the EU economy between 60 and 6,000 euro (at an industrial electricity price of 0.12 €/kWh and a primary energy factor of 2.5).

Using copper results in a highly efficient heat transfer

As with electrical conductivity, the thermal conductivity of copper is second only to silver. This makes copper the preferred material in applications where heat transfer is involved, e.g. in air-conditioning and solar thermal water installations. Its high thermal conductivity reduces the heat losses and the carbon emissions associated with them.

Copper as an environmentally well-performing material

Copper can be 100% recycled without any loss in performance

Unlike most aluminium conductors, which need to be produced from primary metal, copper conductors can be made from 100% recycled material. In 2010, 44% of Europe’s total copper demand was sourced through recycling. The energy required to recycle is approximately 20% of that required for primary production (from mining). Moreover, the relatively high value of copper, combined with its easy recyclability, is a key driver in the recovery and recycling of end-of-life products that would otherwise be lost.

Compactness of copper conductors saves on other types of materials

For the same efficiency and power, a copper conductor will have a cross section that is approximately 40% smaller than that of the equivalent aluminium conductor. This compactness saves, among others, on magnetic materials, on materials for motor or transformer housing, on insulation materials for wires and cables, and on the cabling ducts in urban environments. This brings about obvious economic (lower cost) and ecological (less material) advantages. A similar advantage exists in the use of copper tubes for air-conditioning systems. The excellent thermal conductivity of copper, combined with its high mechanical strength, enables the use of smaller diameter tubes than can withstand the higher pressures required for more environmentally friendly refrigerants. Apart from the direct energy efficiency improvement, more compact installations save on material, as well as on economic and ecological costs.

Lifecycle benefits when using copper

Copper and its characteristics are durable

Copper is a highly durable material that will continue to function throughout its lifetime without a significant loss in performance. The copper component is highly unlikely to be the reason for a device to reach the end of its useful life.

More copper means higher safety and reliability

Degradation (e.g. of cable insulation or motor windings) is often the result of excessive heating caused by the conductor needing to transport a higher current than it is designed for. Optimizing the conductor diameter consequently reduces the risk of electrically induced fires, increases reliability, extends service life, lowers maintenance costs, and reduces the need for a back-up installation. Copper conductors also facilitate high quality joints (welded or bolted). As these are often weak points, durable joints significantly improve the reliability of the energy system.

Copper has a high mechanical strength

The mechanical strength of copper is of high importance for electrical appliances, which have to withstand the forces of short circuit currents, and for thermal applications that have to withstand high pressures. Combined with its excellent electrical and thermal conductivity, the high mechanical strength of copper, and its alloys, delivers resource efficiency through miniaturisation.

Copper is highly corrosion resistant

Because copper develops its own adherent protective coating, it has an excellent resistance to corrosion in all kinds of common environments including atmospheric air, potable water, soil, and even sea water and a wide variety of chemicals. Secondly, since copper is at cathodic extreme of the metal series, it is very insensitive to galvanic corrosion. As a result, copper retains its excellent electrical and thermal conductivity over the years. Neither does corrosion influence the mechanical strength of copper, which is one of the reasons why the material is highly durable.

Copper & other metals’ role for our sustainable future

Metals do not represent a homogeneous group, but collectively they can meaningfully contribute to a more responsible economy and infrastructure by delivering sustainability across their production methods, and in their contribution to clean technologies. Aluminium is vital for light weighting; cobalt, copper and nickel are essential to the growth of the electric vehicle industry, and copper for solar and wind. Tin has done significant work in respect of responsible sourcing on conflict minerals issues and similarly, lead for recycling, as well as being key for energy storage and hydro solutions. Finally, zinc plays a crucial role in protecting steel from corrosion – its durability negating the need for regular replacement – and is critical for wind and geo-thermal clean energy solutions (LME, 2020).

Population growth and the decarbonisation of economies will both significantly increase the demand for metals, and the ability to meet this demand through sustainable means and technologies (including batteries, wind turbines and solar power) will be essential to enable a green future.

Minerals and metals form the backbone of the modern society, as they are present in any settings. You can find metals everywhere in your surroundings and copper it is critical for services and functions of many electronic devices, electricity delivery and storage, transportation, communication and safe drinking water. Infrastructure relies on copper because of its reliability, efficiency and performance.

Most recently, researchers at Ruhr-Universität Bochum and the University of Duisburg-Essen have developed a new catalyst for the conversion of carbon dioxide (CO2) into chemicals or fuels. In a paper published in the journal Angewandte Chemie, the scientists explain that what they did was optimize already available copper catalysts to improve their selectivity and long-term stability (Song et al., 2021).

In relation to the climate change, on average, less than five tonnes of CO2 are emitted to produce one tonne of copper. However, because of copper’s inherent high efficiency in conductive applications, between 100 and 7,500 tons of CO2 emissions can be reduced—a mitigation factor of up to 1,500 to one. By 2030, copper could reduce the world’s carbon footprint by 16 percent (Sustainalbecopper.org, 2021).

The World Bank estimates that under a 2°C scenario4, production of cobalt will have to increase by 450% to meet energy storage demand (compared to 2018), and to meet between 2-4°C climate objectives, by 2050, the demand for relevant metals will increase 300% for wind turbines, 200% for solar panels, and 1,000% for batteries (World Bank, 2020).

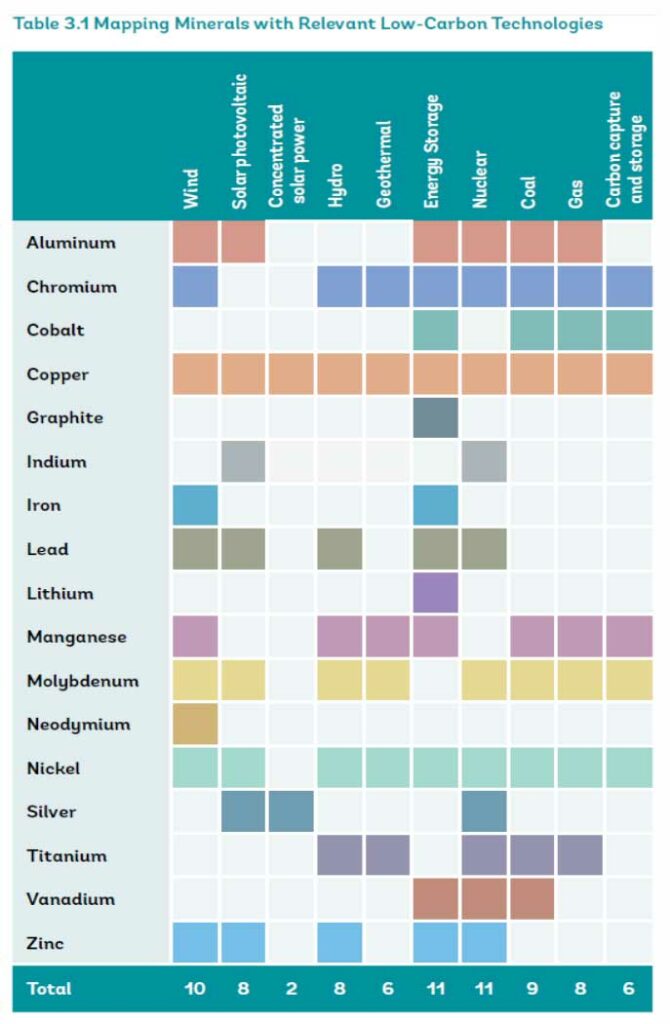

Copper alone is used in more than eight clean energy generation and storage technologies, as it is showed in the table below:

The demand for electric vehicles is expected to see major growth over the next ten years, driven by technology improvements, increased affordability and the deployment of more electric chargers. This increase will cause a greater demand for copper.

Copper’s use in electro-mobility may become even greater with the emergence of energy independent vehicles (EIV) that use copper-powered solar photovoltaic panels to harness renewable energy.

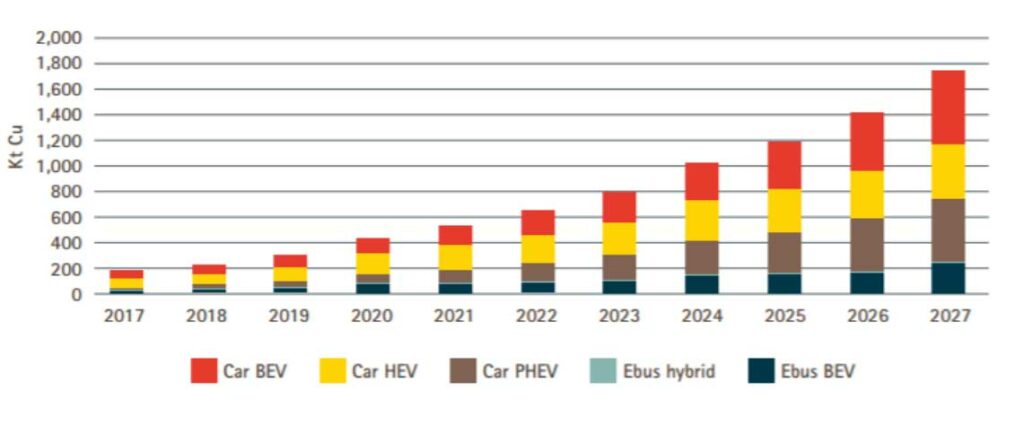

Copper Use in Electric Vehicles Each type of EV uses considerably more copper than traditional vehicles with internal combustion engines.

Copper usage for each vehicle type is listed below:

- Internal combustion engine: 23 kg of copper.

- Hybrid electric vehicle (HEV): 40 kg of copper.

- Plug-in hybrid electric vehicle (PHEV): 60 kg of copper.

- Battery electric vehicle (BEV): 83 kg of copper.

- Hybrid electric bus (Ebus HEV): 89 kg of copper.

- Battery-powered electric bus (Ebus BEV): 224–369 kg of copper (depending on the size of the battery).

It is predicted an increase in the demand for electric cars and buses that will impact the copper market:

- By 2027, an estimated 27 million electric vehicles (including HEV, PHEV, BEV, Ebus HEV and BEV) will be on the road, up from 3 million in 2017.

- This will raise copper demand in EVs from 185,000 tonnes in 2017 to 1.74 million tonnes in 2027.

- In addition, each EV charger will add 0.7 kg of copper. Fast chargers can add up to 8 kg of copper each.

Conclusion

The transition to sustainability and net zero carbon emissions will require the global economies to accelerate the use of clean energy technologies.

A low-carbon future will be very mineral intensive because clean energy technologies need more materials than fossil-fuel-based electricity generation technologies. Greater ambition on climate change goals, as outlined by the Paris Agreement, requires installing more of these technologies and will therefore lead to a larger material footprint.

Copper’s properties are vital for a range of activities including safe energy transmission and efficient transport. From mines and smelters/refiners through to manufacturing, the copper industry needs to further upgrade its capacities to be able to provide the raw material and the finished products to assist society through any challenge.

As copper is required in any of clean technologies of the future, it will be in high demand. The copper price is ultimately the tool for generating the fundamental adjustments in the global copper market.

At current conditions, copper supply chain is not ready to meet the high demand. If copper price will remain below $9,000 per metric ton, there is a risk that the global copper market would face inventory depletion risk by 2023.

According to the Goldman Sachs projection, copper price would need to increase to average $9,675/t in 2021, $11,875/t in 2022, $12,000/t in 2023 before a material step up to $14,000/t in 2024 and $15,000/t in 2025, to allow the metal balances into mid-decade to remain manageable without depletion occurring.

Whether prices need to rise further post-2025, will then depend on whether the price rally has supported enough mine supply response by that stage.